Va Benefits For 90 Disabled

disabled wallpaperBoth types of the Folds of Honor scholarships are based on. Enrollment in VA Healthcare Priority Group 3 or Priority Group 6 veterans with multiple.

6 Important Veterans Benefits You May Not Know About Mike Sheppard In 2020 Veterans Benefits Military Benefits Disabled Veterans Benefits

Veterans Disability Benefits Learn about types of benefits available to some veterans with disabilities.

Va benefits for 90 disabled. These include compensation pensions and grants for veterans with certain service-connected disabilities as well as pensions for some veterans 65 and older and grants for vets with age-related disabilities. According to the Department of Veterans Affairs VA Disability Compensation is. Veteran and Parents 214040.

No cost healthcare and prescription drugs for service connected disabilities if income limits are met Travel allowance for scheduled appointments for care at a VA medical facility or VA authorized health care facility. Complete List of Top 25 Disabled Veteran Benefits. 90 VA Disability Pay.

Okay so lets jump right in and explore the 90 VA disability benefits list in detail. Checklist of Benefits Page 2 Revised August 13 2012. Veterans Benefits Banking Program VBBP 4.

VA Special Monthly Compensation Benefits. Veteran and Parent 201380. VA fee basis outpatient medical card for SC conditions requiring treatment.

The Folds of Honor Foundation has two types of scholarship programs for Texas Disabled Veterans. TIER 2 ELIGIBILITY Eligibility under tier 2 has all the same requirements as Tier 1 except the qualifying Veteran was killed became MIA was taken captive as a prisoner of war. Many veterans who are receiving a 90 percent VA disability rating should be receiving a 100 percent VA disability rating.

Veterans with a 90 percent VA disability rating will receive 178368 while vets with a 100 rating will receive 297886. There are many things you may be eligible for. Waiver of VA funding.

The benefits listed below mainly include scholarships but one opportunity provides funding for several years of education. Veteran and Spouse 204419 if spouse requires aid and attendance add 14486 Veteran Spouse and Parent 217082. Or has been rated permanently 90 disabled or more due to direct involvement in covered military combat.

Travel allowance for scheduled appointments for care at a VA. Summary of VA Benefits Tax-free for Disabled Veterans benefits for Veterans with a service-connected disability 508_VBA_PC-Compensation_Overview_Brochure_110612indd 1 11062012 114402 AM. Monthly Compensation Rates for 90 Percent Disabled Veterans.

10 point Veteran preference in federal hiring. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. Veterans with a 60 or greater disability rating are exempt from some application requirements to receive these transportation discounts.

Eligibility for a VA Pension requires. It is also paid to certain veterans disabled from VA health care. Most of the benefits apply to veterans from all military branches while.

Benefits to Appealing Your 90 VA Disability Rating There are many reasons why appealing your 90 percent VA disability rating may be beneficial. The benefits are tax-free. A benefit paid to a veteran because of injuries or diseases that happened while on active duty or were made worse by active military service.

VA Disability Compensation Pay. In 2020 a 90 percent VA disability rating is worth a minimum of 186296 per month and is tax free at both the state and federal levels. The Veterans Administration often incorrectly rates veterans.

Veteran Spouse and Parents 229744. Low income and assets 90 days of service including at least one day of service during wartime and. Virginia Military Survivors and Dependents Education Program The Military Survivors and Dependents Program provides educations benefits to spouses and children of military service members killed.

For starters if you are successful in appealing your 90 percent disability rating your monthly compensation amount will increase by over 1000 as indicated below. Rated SC 10 overall. Disabled Veteran Public Transportation Benefits Disabled veterans may qualify for discounted public transit fares on Virginias MetroBus and MetroRail systems.

1 The Childrens Fund Scholarship serves the dependents of disabled veterans rated at 90 or higher in Kindergarten through 12th grade and 2 The Higher Education Scholarship the dependents of disabled veterans rated at 10 or higher for those seeking a first bachelors degree or a certification at a post-secondary institution. 90 VA Disability Pay Rate in 2020. Their qualifying veteran must meet residency requirements and be rated permanently 90 disabled or more due to military service.

No cost health care and prescription medications. VA Pension is a monthly cash benefit that assists disabled or retired veterans.

Can Disabled Veterans Get Social Security Disability

disability disabled veteransDont take your case for granted. Lots of veterans receive both 100 VA Disability and Social Security Disability.

What Not To Say When Filling Out Social Security Disability Papers Disabili Social Security Disability Benefits Social Security Disability Disability Benefit

By Margaret Wadsworth If you are a disabled veteran you might be eligible to receive disability benefits from the Social Security Administration if you are unable to work full-time.

Can disabled veterans get social security disability. Social Security Disability SSDI for Veteran. Veterans who receive or are eligible to receive VA compensation for service-connected medical issues may be qualified to receive Social Security Disability Insurance also known as SSDI. In addition Veterans may not realize they can sometimes qualify for both VA and Social Security benefits.

Disabled veterans can get Social Security disability benefits at the same time as VA disability compensation. Rules change and as the Noble case shows even disabled veterans can have a hard time getting Social Security disability. Social Security disability for veterans is available solely for claimants whose impairments last 12 months or longer.

The SSA looks at how much your health problems limit your ability to work when determining your eligibility for monthly SSD benefits. Get some help with your claim. The date of the disability itself does not matter in these cases.

A second Social Security benefit Social Security Insurance offers government funds to help those in need with or without military service. For some reason a large number of veterans believe they can only receive 100 VA Disability or Social Security Disability that is not true. VA approval does not help get Social Security disability.

In past decisions federal circuit courts found that VA disability ratings were entitled to great weight. Veterans who are already receive VA benefits can potentially be eligible for either Supplement Security Income SSI or Social Security Disability Insurance SSDI. Americans who engage in military service can suffer from mental and physical side effects lasting a lifetime.

Although VA benefits are designed to provide monthly supplements in proportion to your disability some veterans with severe conditions require extra assistance. If you are a military veteran suffering from PTSD you may qualify. In the past if you were the recipient of a very high VA rating 70 or higher your chances for success on your Social Security disability claim were quite good.

Approximately 621000 military Veterans received disability insurance benefits in 2016. Veterans can qualify for both VA benefits and Social Security disability insurance SSDI. Rest assured that if the unexpected happens weve got you covered.

Veterans who worked and paid Social Security taxes long enough in either military or nonmilitary jobs can collect Social Security Disability Insurance SSDI. The expedited process is generally open to those who became disabled while serving on active duty on or after October 1 2001. Read the Eleventh Circuits discussion of SSA vs.

Severely disabled veterans are able to collect Social Security disability benefits in addition to veterans disability benefits. Those who are VA-rated 100 permanently and totally disabled may be eligible to get expedited claims processing for Social Security benefits. A VA compensation rating of 100 Permanent and Total does not guarantee that you will receive Social Security disability benefits.

In some cases Social Security Disability SSD benefits are available for veterans with PTSD. However their programs processes and criteria for receiving benefits are very different. Veterans can obtain both 100 VA Disability and Social Security Disability benefits at the same time.

In this case Social Security disability benefits may be an option. Veterans who did not but who have low income and low assets can collect Supplemental Security Income unless their VA benefits put them over the income limit for SSI. To be approved for Social Security benefits you must meet Social Securitys definition of disability.

These veterans who have become disabled may be entitled to receive disability benefits from the Social Security Administration. Below learn about what post-traumatic stress disorder is and how military personnel may qualify for disability for veterans with PTSD. Both Social Security and VA pay disability benefits.

Learn more on our Disability Facts page.

Do 100 Disabled Veterans Pay Sales Tax On Vehicles In Virginia

disabled sales wallpaperIndividual Income Tax Return to correct a previously filed Form 1040 1040A or 1040EZ. Which quote in part.

Kentucky First Time Home Buyer Mortgage Loans Down Payment And Credit Score Require Mortgage Refinance Calculator Mortgage Loans Mortgage Repayment Calculator

See all Washington Veterans Benefits.

Do 100 disabled veterans pay sales tax on vehicles in virginia. Cox and Cuff help lead the Disabled American. This amendment would exempt disabled veterans from property taxes for motor vehicles. What personal property taxes are.

The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability. A vehicle tax amendment is projected to pass in Virginia according to the Associated Press. Counties and cities in Virginia also impose personal property taxes on vehicles but the rate all depends on the specific locality and how the cars are assessed.

Only California Montana New Mexico North Dakota Rhode Island Utah Vermont and Virginia require veterans to pay taxes on their retirement income. Under the acting state law generally Virginias Constitution required all property to be taxed with few exemptions. The tax exemption up for a vote would apply to vehicles.

Applicants with less than a 100 VA disability rating may qualify for a partial exemption. One on their home and one on their vehicle. 100 percent disabled veterans should also look into other state-offered benefits such as those associated with property taxes and vehicle registration.

This is known as a tangible personal property tax. Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75 whichever is greater. To apply please complete and provide the information and documentation requested on the Disabled Veterans Tax Relief Form and return it to the Commissioner of the Revenue.

The applicant holds a valid title or registration issued to himher by another state or a branch of the US Armed Forces. Was passed many a year ago and all military bases and surrounding cities cite no loss of revenue from us 100 disabled vets from the sales tax we would have paid if we didnt have the state of OK disabled vetererans 100 card all stores axcept it and most will give other bennies on top of that card plus new car every three years with no tax 6 bucks a year for ttl no pay for fishing. To do so the disabled veteran will need to file the amended return Form 1040X Amended US.

Veterans with 100 percent disability ratings may request a property tax waiver although each state may have different qualification requirements. Motor Vehicle Sales and Use Tax. Sales tax exemption.

The Fairfax County Board of Supervisors adopted a lower Vehicle Tax rate of 001 per 100 of assessed value on one motor vehicle owned and regularly used by a qualifying disabled veteran in accordance with the Code of Virginia 581-3506 A 19. I am receiving 100 VA Compensation and am also receiving Military Retired Pay read more. Sales of tangible personal property or services to personsin receipt of disability compensation at the one-hundred-percent rate and the disability shall be permanent.

Virginia has a 415 percent motor vehicle sales and use tax based on the vehicles gross sales price or 75 whichever is greater according to the Virginia Department of Motor Vehicles. The reduced Vehicle Tax rate is subject to adoption by the Board of Supervisors during their deliberation on the Countys annual budget process. Owners of 200K homes at Beach could save more than 1700 annually.

Question 2 amended the Virginia Constitution to provide veterans who have 100 percent service-connected permanent and total disabilities with a tax exemption for one automobile or pickup truck. The applicant has either owned the vehicle for longer than 12 months or provides evidence of a sales tax paid to another state. According to current Virginia law residents pay two main types of property taxes.

Under the new proposed law veteran motor vehicles would be exempt from. Disabled veterans in the State of Washington may qualify for need-based property tax exemptions on a primary residence provided there is a 100 service-connected disability rating. 100 disabled veteran PURSUANT TO HB 1547.

Disabled veterans spouses no longer have to pay real estate tax to their municipalities. Is my Military Retired Pay - US Army Pension exempt from Federal Income Tax as I am 100 Disabled Veterans Adminstration. Shall not exceed twenty-five thousand dollars 25000 per year per individual.

A 100 percent disabled veteran or any veteran over the age of 65 in West Virginia is exempt from paying taxes on the first 20000 of assessed value on a self-occupied property if the veteran was a resident of the state at the time they enter military service. In Virginia local governments can adopt annual taxes that are levied on a motor vehicles value. The vehicle is being registered for the first time in Virginia.

Today both of these Virginia veterans are 100 disabled due to their military service though they didnt want to share details of their conditions. For the purposes of the Motor Vehicle Sales and Use Tax collection gross sales price includes the dealer processing fee. Washington Property Tax Exemption.

Many other states have state income tax but. Effective July 1 2016 unless exempted under Va. Each qualified veteran receives a reduced tax rate of 150 per hundred dollars of assessed value on one vehicle owned and regularly used by the veteran.

Disabled Vet Benefits Colorado

benefits colorado disabled wallpaperActive duty Colorado residents that are stationed outside of the state may fish without a license while on temporary leave in Colorado. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child.

List Of Benefits Due To Service Connected Disability Veterans Resources Disabled Veterans Benefits Va Disability Benefits Disability Benefit

List Of Benefits Due To Service Connected Disability Veterans Resources Disabled Veterans Benefits Va Disability Benefits Disability Benefit

The military member or veteran must show proof of military service photo ID DD-214.

Disabled vet benefits colorado. Veteran Benefits In Colorado Disability Benefits for Veterans in Colorado. FREE Healthcare and Prescription Medications for Disabled Veterans. Next look at the Added amounts table.

Health Insurance Benefits for Veterans in Colorado. Free admission to all state parksrecreation areas for veterans with a Disabled Veterans License Plate. Pension Benefits for.

This benefit is only valid for 30 days and with proof of leave. Free lifetime combination small-game hunting and fishing license for a. Current law provides 2 means by which veterans with qualifying disabilities may be exempted from paying vehicle ownership tax and registration fees.

Summary of Colorado Military and Veterans Benefits. The State of Colorado offers special benefits for its military Service members and Veterans including Retired Military Pay and Property tax. You know that as a disabled veteran you are eligible for many benefits the problem is knowing what they are and how to get them.

Find the amount for children under age 18 6100. Federal VA health care coverage is available to eligible veterans. Colorado Revised Statute CRS 42-3-2135aI authorizes the Department to issue Disabled Veteran license plates to an owner of a motor vehicle to which such license plate is attached that is a disabled veteran of the United States Armed Forces.

Veteran and Spouse 204419 if spouse requires aid and attendance add 14486 Veteran Spouse and Parent 217082. Resident Fishing on Temporary Leave. Depending on the type of qualifying dependent s veterans rated as 90 percent disabled began receiving the following monthly compensation amounts.

Other benefits you may be receiving eg VA pension benefits Veterans with service-connected disabilities are given the highest priority. Importantly veterans with a 100 percent VA disability rating meet the eligibility requirements for Health Care Priority Group 1. Available VA disability benefits include general compensation Dependency.

PROPERTY TAX EXEMPTION FOR QUALIFYING DISABLED VETERANS OVERVIEW. The amendment and subsequent legislation expanded the senior property tax exemption to include qualifying disabled veterans. There are many things you may be eligible for including free.

Active duty and veterans are admitted free to Colorado state parks on Veterans Day. The first exemption is associated with the issuance of a disabled veteran license plate but the second exemption is not specifically associated with the issuance of the disabled veteran license plate. All other park fees camping etc are still charged.

Colorado Veteran Recreation Benefits Hunting Fishing License for Disabled Veterans. This is one of the top disabled veteran benefits which includes free health care for disability conditions related to military service for veterans with a disability rating of at least 50 as well as for those who cant afford to pay for care. Hunting Fishing License for Active Duty.

For disabled veterans who qualify 50 percent of the first 200000 of actual value of the veterans primary ce is residen exempted. In 200 Colorado voters amend6 section 35ed of article X of the Colorado Constitution. Non-residents of Colorado and their families can get hunting and fishing.

Whether you qualify for Medicaid. Veteran Spouse and Parents 229744. The bill clarifies that a veteran who is disabled need not obtain the disabled veteran license plate to qualify for the second exemption.

Disabled American Veterans Pay Scale

disabled veterans wallpaperIf our prediction holds true this means Disabled Veterans with a current VA disability rating of 10 of higher would receive a 11 increase in their VA disability pay rate for calendar year 2021. Find the amount for children under age 18 6100.

Perfect Va Compensation Rates 2017 Table And View Va Disability Military Retirement Pay Va Benefits

Perfect Va Compensation Rates 2017 Table And View Va Disability Military Retirement Pay Va Benefits

Filter by Job Title.

Disabled american veterans pay scale. The 2021 COLA jump is estimated to be 11 which means disabled veterans rated at 10 or higher by the VA will receive a 11 increase over and above their 2020 VA pay rates. Average Hourly Rate for Disabled American Veterans Employees. VA Disability Pay Dates 2021 Tracker.

2021 VA Disability Compensation Rates are effective as of Dec. Current VA Disability Compensation Pay Rates 2021 VA Disability Compensation Rate Increase 13. To find the amount payable to a 70 disabled veteran with a spouse and four children one of whom is over 18 and attending school take the 70 rate for a veteran with a spouse and 3 children 165671 122 177871 and add the rate for one school child 19700.

The total amount payable is 197571. National Service Officer salaries - 7 salaries reported. Caregivers play an important role in the health and well-being of veterans.

Disabled American Veterans employee benefits and perks data. The 13 COLA raise in 2021 is slightly less than the 16 raise veterans received in 2020. The following tables show the 2021 VA disability rates for veterans with a rating 10 or higher.

These are the latest VA disability compensation rates for 2020. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. For example if you were previously getting 1000 per month tax-free a 11 VA pay increase is 11 so a veterans VA disability compensation pay in 2021 would go up to 1011 per month.

Disabled American Veterans Salaries. According to our data the highest paying job at Disabled American Veterans is a Senior National Service Officer at 51000 annually while the lowest paying job at Disabled American Veterans is an Administrative Assistant at 34000 annually. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child.

The VA offers a number of services to support family caregivers including monthly payment or stipend to designated. Find information about retirement plans insurance benefits paid time off reviews and more. 1 2020 Dependents Allowance.

To find the amount payable to a 70 disabled veteran with a spouse and four children one of whom is over 18 and attending school. Find the amount for children under age 18 6100. Veteran Service Representative salaries - 3 salaries reported.

Next look at the Added amounts table. Certified Medical Assistant CMA. Next look at the Added amounts table.

Administrative Assistant salaries - 3 salaries reported. VA disability compensation pay is a tax-free benefit paid to veterans with injuries or diseases obtained during or made worse by active duty.

Do Widows Of Disabled Veterans Get Benefits

disabled widowsThere are many things you may be eligible for including health insurance. VA Benefits for Spouses of Disabled Veterans June 24 2019 Spouses of disabled veterans may be eligible for VA benefits such as disability compensation health care education and training employee services insurance coverage and survivors benefits.

Military Service Impacts The Entire Family And As The Saying Goes You Don T Just Marry The Servicemember You Marry Widows Benefits Funeral Planning Veteran

Military Service Impacts The Entire Family And As The Saying Goes You Don T Just Marry The Servicemember You Marry Widows Benefits Funeral Planning Veteran

It may seem daunting to try and understand all the benefits you may be eligible for as the spouse of a disabled veteran.

Do widows of disabled veterans get benefits. It can be hard to navigate through the applications and details though so get a free consultation with a VA Disability Lawyer to make sure you arent missing anything. Department of Veterans Affairs VA for a total disability rating before he died. To qualify she needed proof that her husband had been totally disabled but her husband had never applied to the US.

Military veterans are eligible for a number of government benefits most notably a pension and Dependency and Indemnity Compensation. These benefits may include employment assistance free counseling and property tax exemptions. You can still file a claim and apply for benefits during the coronavirus pandemic.

This benefit is called Dependency and Indemnity Compensation DIC and it is paid on a monthly basis. The Veterans Administration requires that widows deceased veteran husbands actively served for at least 90 days at least one of which was during a time of war. A VA Survivors Pension offers monthly payments to qualified surviving spouses and unmarried dependent children of wartime Veterans who meet certain income and net worth limits set by Congress.

Permanently incapable of self-support due to a disability before age 18. In some cases a dependent parent may also be eligible for DIC. Surviving military spouses can sometimes receive veterans disability compensation.

As the survivor of a Veteran or service member you may qualify for added benefits including help with burial costs and survivor compensation. The benefits offered may vary from state-to-state so it is a good idea to check with your states Department of Veterans Affairs to learn more. Additional Compensation for Veterans Rated Over 30 Disabled.

Find out if you qualify and how to apply. Under age 23 if attending a VA-approved school OR. The specific amount varies depending on the level of disability but he receives additional compensation for his wife and any other dependents.

For additional information see DI 10110001G2 in this section. While an un-remarried spouse is eligible at any age a child of a deceased wartime Veteran must be. Though the surviving spouse will not continue to receive disability benefits this back payment can be paid if applied for in VA application form 21-354.

DIC is available to a surviving military spouse a widow or widower and his or her dependent children. If a widow er receiving D benefits ie benefits paid to widows ers age 60 and older becomes disabled after attaining age 60 and is still within the prescribed period he or she may file a DWB claim for Medicare entitlement purposes. To quality for a pension a widows income must be relatively low.

As the spouse or dependent child of a Veteran or service member you may qualify for certain benefits like health care life insurance or money to help pay for school or training. The widow was attempting to claim a state property tax break that was designed to help veterans and their survivors but there was a problem. The spouses state of residence may offer additional benefits to the spouses of disabled veterans.

If the claim is later approved the widow may be entitled to the accrued disability benefits that are due to the deceased service member. Your yearly family income must be less than the amount set by Congress to qualify for the Survivors Pension benefit. When a service member becomes disabled due to a service-related injury or illness and is honorably discharged he receives disability compensation from the United States Department of Veterans Affairs.

VA benefits for spouses dependents survivors and family caregivers. There are a lot of benefits for widows and widowers of veterans. A surviving spouse may even have access to money that they were not receiving prior to the death of the veteran.

100 Disabled Veteran College Benefits

benefits disabled veteran wallpaperThe Folds of Honor Higher Education Scholarship is available to. For each additional child under age 18 add another 8605.

State Veterans Benefits Veterans Benefits Va Disability Benefits Va Disability

State Veterans Benefits Veterans Benefits Va Disability Benefits Va Disability

100 VA Pay Rate.

100 disabled veteran college benefits. See how much of your GI Bill benefits you have left to help pay for school or training. The Survivors and Dependents. Children of disabled veterans may take advantage of state and federal financial aid earmarked specifically for children of disabled missing in action or deceased veterans.

Total property tax exemption for 100 disabled veterans and their surviving spouses. Folds of Honor Higher Education Scholarship. Check your Post-911 GI Bill benefits.

Summary of VA Benefits Tax-free for Disabled Veterans benefits for Veterans with a service-connected disability 508_VBA_PC-Compensation_Overview_Brochure_110612indd 1 11062012 114402 AM. If service-connected disabilities rated at 60-90 cause unemployability the veteran may be paid at the 100 rate by VA. The VA uses priority groups to balance demand for VA health care enrollment with resources.

Description of College Benefits for Dependents of Disabled Veterans Dependents Education Assistance Program. Veteran with Spouse and Two Parents. Each subsection sets forth the standard by which veterans may meet the requirements for TDIU.

Medical benefits package includes. As part of our mission to serve you VA provides disability compensation to eligible. In addition service members who are awarded the Post-911 GI Bill may as of 2009 transfer their unused college benefits to dependents or spouses.

Manage your Veterans education benefits View your VA payment history. Again TDIU pays the same monthly compensation rate as a 100 VA disability rating which as of December 2020 was 314642. If the disabled veteran is married the compensation is 327922.

VA outlines TDIU regulations under 38 CFR 416 which encompasses subsections a and b. Veteran with One Parent. Veteran with Spouse Only.

As of 2020 the monthly compensation for a single 100 disabled veteran is 310604. Dependents of permanently disabled veterans may be eligible for education. Veteran with Two Parents.

The Marine Gunnery Sergeant John David Fry Scholarship Fry Scholarship is for children and spouses of service members who died in the line of duty. The Veterans Land Board Veterans Land Loan Program is the only one of its kind in the nation giving Texas Veterans and Military Members the opportunity to borrow up to 150000 to purchase land at competitive interest rates while typically requiring a minimum five percent down payment for tracts of one acre or more. There are 2 main GI Bill programs offering educational assistance to survivors and dependents of Veterans.

Classified as 100 totally and permanently disabled as a result of active military service. Or surviving spouses of 100 disabled veterans are automatically ranked at the top of the eligibility list when they pass a test for state employment. Veterans with 10 - 90 VA disability can get a reduction of their homes assessed value from 5000 - 12000.

The program covers the unpaid part of the cost if any of tuition mandatory fees and on-campus room and board after three months of Dependents Education Assistance DEA benefits have been deducted from the total cost. Filing a claim and establishing service-connected disabilities provides certain. VA compensation is not subject to Federal or State taxes.

VA will consider all disabilities when they are included within the claim. Honorably discharged veterans and their spouses. Transfer Post-911 GI Bill benefits.

Veteran with Spouse and One Parent. Additional for Aid and Attendance. See your payment history for VA education and other benefits you may have like disability compensation and pension.

Veterans with a 100 percent disability rating are eligible to enroll in Health Care Priority Group 1 with no co-payments required. 100 VA Disability Pay Rates 2020 Without Children What is 100 VA Disability Worth in 2020. If there is a spouse and child monthly compensation is 340604.

Texas Disabled Veteran Home Loans.

Military Id For Spouse Of Disabled Vet

disabled spouseSalute the military community with exclusive military discounts for active duty veterans military spouses and families. To qualify the couple must have been married for at least 20 years overlapping the members military career.

218 C P Exam Answer Key The Veteran Claims Expert Richard Shuminsky Youtube Exam Exam Answer Veteran

218 C P Exam Answer Key The Veteran Claims Expert Richard Shuminsky Youtube Exam Exam Answer Veteran

It should be noted that unless being used for proof of insurance to medical providers or a few other limited situations that are excluded from the law a military identification card should not ever be photocopied.

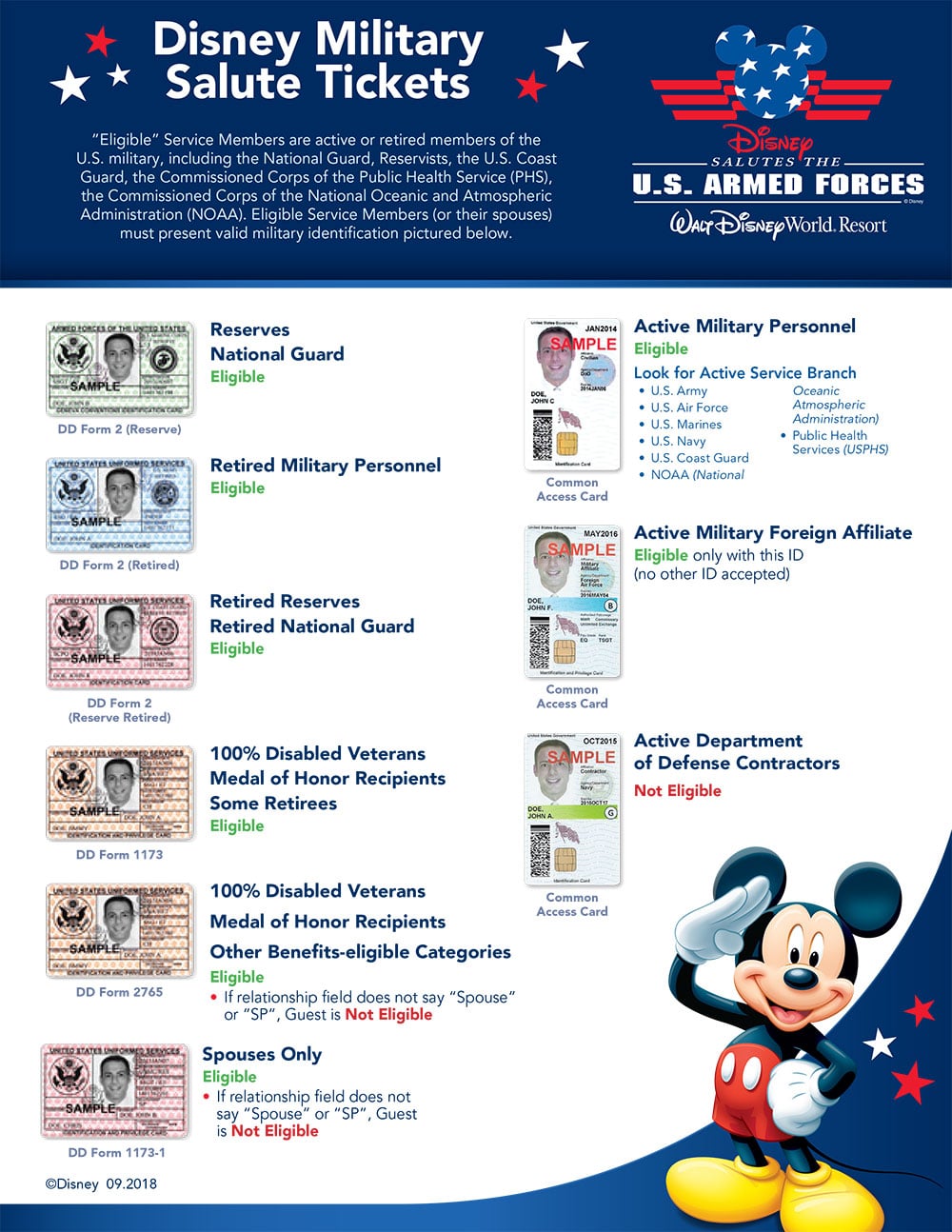

Military id for spouse of disabled vet. Surviving spouses are permitted to apply after the death of the veteran but there may be serious delays if you wait until a need-based moment to apply. These cards may be issued to lawful spouses un-remarried surviving spouses and unmarried children as long as they meet required conditions. Of Defense ID is very nice to have got the kids into Disneyworld last year at half price.

When you have this card you wont need to carry around your military discharge papers or share sensitive personal information to receive discounts. ID Cards for Eligible Family Members of Living and Deceased Retired Soldiers DD Form 1172-1 Uniformed Services Identification and Privilege Card is issued to eligible Family members of Gray Area retirees. For spouses of any Service Member Veteran or Retiree as defined above.

Recent reports say the cards will finally be available in November. In the case of the former once he is out of the military yes he is a vet and he could get a veterans ID card from the VA but it is not a military ID card - and he does not have a military. The former spouse retains an ID card and all benefits that go along with it including Tricare medical access to military installations the commissary etc.

A military ID card or dependent ID is a valuable card that can unlock a variety of valuable benefits such as health care through TRICARE education benefits and access base facilities including the commissary base exchange MWR centers and other support agencies. All children are under 18 or under 23 and still in school. Military ID Verification Services Increase brand loyalty and sales by providing discounts to active duty veterans military spouses and families.

Military Family - Your father mother son or daughter iswas in the military. This includes Surviving Spouses who can verify as a Military Spouse. Spouses of 100 disabled veterans are eligible for an ID card.

The Veterans Identification Act of 2015 ordered the VA to issue ID cards to all honorably discharged veterans for free. The military spouse ID card allows access to health care and serves as an insurance card of sorts both on the military installation and with medical providers not affiliated with the military. Military Dependent ID Card.

A Veteran ID Card VIC is a form of photo ID you can use to get discounts offered to Veterans at many restaurants hotels stores and other businesses. Currently a handful of states allow veterans to have their military service noted on their drivers license. Spouses and children of disabled veterans may be eligible for reimbursement for inpatient and outpatient services prescription medications medical equipment nursing care and mental health care as long as the following remains true.

A Veteran ID Card VIC is a form of photo ID you can use to get discounts offered to Veterans at many stores businesses and restaurants. Yes the 100 disabled veteran needs hishers DD214 along with the VA letter just call the national toll free number and they will get you a letter in the mail. A DD Form 1173 Uniformed Services Identification and Privilege Card is issued to eligible Family members of a retiree.

There are many things you may be eligible for including health insurance. It may seem daunting to try and understand all the benefits you may be eligible for as the spouse of a disabled veteran. Minister for Defence People and Veterans Tobias Ellwood said.

Your veteran spouse can soon receive a veterans ID card. Also caregivers who are registered in the Program of Comprehensive Assistance for Family Caregivers and who receive a letter from the. For more on verifying as a Surviving Spouse click here.

Surviving dependents of deceased Reserve Members National Guard Members retired Reserve Members not yet age 60 and former members not in receipt of retired pay may also be eligible for an ID card. Your spouse will need their original birth certificate along with your marraige license. Married veterans with 100 permanent total disability ratings should know that their spouses should apply for VA Dependency and Indemnity Compensation DIC benefits before the death of the veteran.

All other veterans will be able to apply for a new ID card by the end of this year to mark their time in the armed forces. A surviving spouse and eligible children of deceased active-duty members retired military members Medal of Honor recipients and 100 disabled veterans are eligible for military IDs. An immediate family member of Service Member Veteran or Retiree.

The veteran and their spouse remain married. The military dependent ID card is issued to close relatives of active-duty membersveterans who meet Department of Defense eligibility criteria. Find out if youre eligible for a Veteran ID Card and how to apply.