How To Calculate Ex Spouse Military Retirement

spouse wallpaperIf the former spouse was married to the service member for at least 20 years of their military service prior to the divorce the spouse is entitled to lifetime military benefits including commissary medical benefits and military exchanges. Call Social Security at 800-772-1213 to make an appointment.

How Much Is Military Retirement Worth Calculate Present Value Of Retirement Pay

How Much Is Military Retirement Worth Calculate Present Value Of Retirement Pay

Retired Pay will submit the application to DFAS for consideration.

How to calculate ex spouse military retirement. Under the former rule in Colorado the marital share of the retirement would be 5 years of marriage overlapping 28 years of service or 1786 and the former spouses share is half of that or 89. Known as the 1010 rule this often causes confusion as people believe that the former spouse is not entitled to retirement unless the couple was married for at least 10 years. If the former spouse of a military service member is awarded a share of the ex-spouses military retirement pay the service member served for at least 10 years and the former spouse was married.

A former spouse must have been awarded a portion of a members military retired pay in a State court order. If there is less than 20 but at least 15 years of overlap between the marriage and the military service of the member the former spouse is entitled to one year of medical benefits only. The spouse only can get half of the retirement pay if married the entire 20 year period the military member was in the service.

If you are a former spouse of a retired member of the military you must complete and submit the first page of the DD Form 2789 including all supporting documentation to your Retired Pay Office. For example if the Participant accrued 15 years of service while married and retires with 30 years of total service the ex-spouses share will be 25 percent of the pension 50 percent 1530. Court Order The court order should contain sufficient information for us to determine whether the Servicemembers Civil Relief Act SCRA or SSCRA and the USFSPAs jurisdictional and 1010 requirements if applicable have been met.

The Uniformed Services Former Spouse Protection Act doesnt. Place a ceiling on the percentage of disposable retired pay that may be awarded. 50 of multiplied by 80 40.

Assuming a 25 annual multiplier the members retirement would be 28 x 0025 x 6800 or 4760. The marital share of the service members disposable retired pay would be 80. Following a dissolution of marriage a former spouse who has at least 10 years of marriage overlapping 10 years of creditable military service may apply for direct payment of the retirement from the Defense Finance Accounting Service DFAS.

Establish a formula for dividing military retired pay. The USFSPA directs the former spouses eligibility to divide this asset. Code 1408 d 2.

A world class pension scheme for your military service. Pension service multiple x pay base. Pay base is different from base pay.

16 divided by 20 80. The Uniformed Services Former Spouses Protection Act allows state courts to divide military pensions as part of a divorce decree so military pay and pensions can be split in a divorce based on each states laws. The military retirement pension formula is.

Months of Marriage Overlapping Military Service Total Months of Military Service at the Time of Retirement. The marital share amount of your military pension is determined by adding up the number of months you were married and serving in the military then dividing this number by the total time you served in the military before separation. The Majauskas formula may be modified by the court or by agreement between the Participant and ex-spouse.

Require courts to divide military retired pay. If the court chooses to award the members spouse 50 of the marital share the spouse will receive 40 of the service members disposable retired pay. When a member of the armed forces reaches their retirement age they receive one of the most generous pensions available in the UK.

If a service member is already retired when a divorce begins then calculating and dividing the military pension is relatively easy. To qualify for the division of retirement pay under the USFSPA the couple must have been married for at least 10 years during which time the servicemember must have performed at least 10 years of creditable military service. Page updated October 8 2020.

The Uniformed Services Former Spouses Protection Act USFSPA Title 10 United States Code Section 1408 passed in 1981 accomplishes two things. A former spouse should also indicate the priority of the awards to be enforced in case there is not sufficient disposable retired pay to cover multiple awards. For instance if the military member does 20 years and the spouse was only married to the military member for a total of 5 years the spouse is not entitled to half of the retirement money.

Marital share can be calculated by dividing months of marriage overlapping military service by total months of military service at the time of retirement. A representative at your local Social Security office can provide estimates of the benefit you can receive as a divorced spouse based on your former wifes or husbands earnings record. Then multiply that by 5 and youll have her marital share.

Service multiple comes from the number of years of service or Reserve drill points two different formulas. Ex spouse military retirement calculator REDUX Calculator - This calculator estimates your retirement benefits under the REDUX retirement plan for those who opted for the Career Status Bonus at 15. Your form must be hand signed and dated.

Award a predetermined share of military retired pay to former spouses.

Military Retirement Invitation Created By V Retirement Invitations Military Retirement Retirement Invitation Template

Military Retirement Invitation Created By V Retirement Invitations Military Retirement Retirement Invitation Template

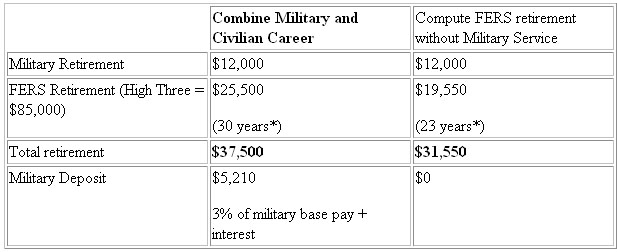

Mixing Civilian And Military Retirement Government Executive

Mixing Civilian And Military Retirement Government Executive

Military Compensation Pay Retirement E7with20years

Military Compensation Pay Retirement E7with20years

Guide Military Retirement During Divorce Cook Cook Law Firm Pllc

Guide Military Retirement During Divorce Cook Cook Law Firm Pllc

Comparing E7 Retirement Pay Active Duty Versus Reserve Military Guide

Comparing E7 Retirement Pay Active Duty Versus Reserve Military Guide

Pin By Joshua Tanner On Organise Cleaning In 2020 Financial Counseling Learning Management System Saving For Retirement

Pin By Joshua Tanner On Organise Cleaning In 2020 Financial Counseling Learning Management System Saving For Retirement

How To Calculate Child Support Findlaw Child Support Calculator Ideas Of Child Support Calculator C Child Support Quotes Child Support Child Support Laws

How To Calculate Child Support Findlaw Child Support Calculator Ideas Of Child Support Calculator C Child Support Quotes Child Support Child Support Laws

Pin On Top Posts At The Military Guide

Pin On Top Posts At The Military Guide

How To Calculate Reserve Or Guard Retirement Points Military Benefits

How To Calculate Reserve Or Guard Retirement Points Military Benefits

Military Retirement Pay Chart 2020 Military Pay Chart Military Retirement Pay Military Pay

Military Retirement Pay Chart 2020 Military Pay Chart Military Retirement Pay Military Pay

Blended Retirement System Lump Sum Calculator Military Life Planning

Blended Retirement System Lump Sum Calculator Military Life Planning

Military Compensation Pay Retirement O6with30years

Military Compensation Pay Retirement O6with30years

2013 Usfspa Changes In Pennsylvania Military Retirement Pay Military Divorce Divorce

2013 Usfspa Changes In Pennsylvania Military Retirement Pay Military Divorce Divorce

The A B C S Of Military Transition Military Transition Military Military Wife Life

The A B C S Of Military Transition Military Transition Military Military Wife Life

Calculation Of Military Retirement Pay Shares Military Divorce Guide

Calculation Of Military Retirement Pay Shares Military Divorce Guide

Calculate Child Support Payments Child Support Calculator Parental Income Influences Child Support Child Support Quotes Child Support Payments Child Support

Calculate Child Support Payments Child Support Calculator Parental Income Influences Child Support Child Support Quotes Child Support Payments Child Support

How To Calculate The Value Of A Guard Reserve Retirement Military Guide

How To Calculate The Value Of A Guard Reserve Retirement Military Guide

How Not To Calculate Military Retirement Pay Us Vetwealth

How Not To Calculate Military Retirement Pay Us Vetwealth